Mobile Home Loan Program

Are you looking to replace your current mobile home with a new, more efficient one? The Mobile Home Loan Program (MHLP) offers an incredible opportunity for eligible residents in Unincorporated San Mateo County to secure low-cost loans for purchasing and installing new mobile homes.

About

The MHLP, offered by the Housing Endowment and Regional Trust (HEART) of San Mateo County, provides loans to residents in qualifying parks who need to replace their aging mobile homes. With loan amounts up to $100,000 and no down payment required, our program is tailored to meet your financial needs.

Eligibility

Requirements

To qualify for a loan, participants must meet the following requirements.

Residency Requirements

You must live in one of the following parks: Bayshore Villa, Belmont Trailer, La Honda Trailer Park, Pillar Ridge, Redwood Trailer Village, Sequoia Trailer Park, or Trailer Villa.

Ownership Requirements

The mobile home must be your main residence, you must be the primary owner, and you cannot own another home regardless of location.

Income Requirements

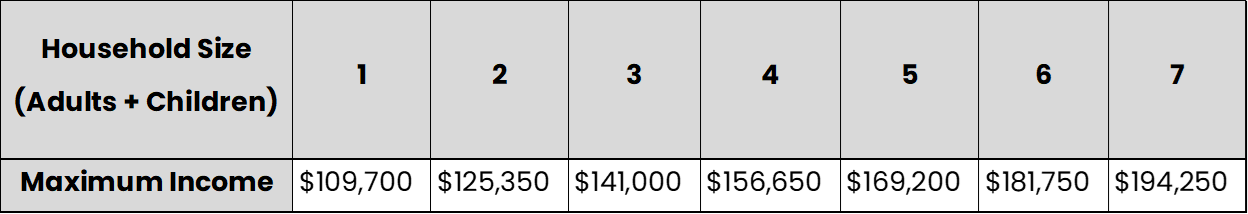

Your household income must not exceed the specified limits for eligibility:

Loan Terms

30-year Amortized, fixed rate loan

Fixed rate interest falls between 0.25% and 3.0% interest based on household income and qualifications.

Mobile Home Loan Amounts up to $100,000

Loan amount is based on household income and ability to make monthly loan payments.

No Down Payment for mobile home units

There is no down payment requirement for the mobile home loan program.

What Else this loan will cover for MHLP

Loan proceeds can fund the demolition of the old unit, and the purchase and installation of the new unit.

How it works

The MHLP Process

One

Application and required documents submitted to HEART

Two

If eligible, HEART will provide loan pre-approval letter

Three

Resident will look for new unit. HEART will provide a list of vendors for selection

Four

Resident must secure approval from park owner for the replacement unit

Five

Once you’ve selected a vendor and unit, HEART will manage closing process when purchasing

Six

Vendor will work with resident to complete the demolition of the old unit and install a new unit

Community Meetings

HEART and the San Mateo Department of Housing will hold information sessions for residents during the month of June.

Redwood + sequoia Trailer Residents

Thursday, June 13, 2024 | 6:00 PM - 7:30 PM

KIPP Excelencia Community Prep

2950 Fair Oaks Avenue, Redwood City

Bayshore + Trailer Villa Residents

Tuesday, June 18, 2024 | 6:00 PM - 7:30 PM

Fair Oaks Community Center

2600 Middle Field Road, Redwood City

Belmont Trailer Residents

Thursday, June 20, 2024 | 6:00 PM - 7:00 PM

SMC HSA Office

400 Harbor Boulevard, Building B, Belmont

Can't Make It?

Feel free to reach out to us with questions, and we'll keep in touch.

Commonly Asked Questions

Who is running the MHLP Program?

HEART manages the MHLP and will act as the loan administrator: reviewing applications and eligibility, underwriting loans, and providing pre-approval letters. HEART will also manage the escrow and closing process.

HEART (the Housing Endowment and Regional Trust of San Mateo County) is a non-profit agency focused on the affordable housing needs in the County of San Mateo (“County”) and have had a long-standing partnership with the County.

Their mission is to create and preserve affordable housing for low-and moderate-income families throughout San Mateo County. They have extensive experience providing loans for housing developments, preservation, acquisition, and rehabilitation. HEART is uniquely positioned to assist the County with this new program.

Which mobile home parks are eligible?

You must currently live in one of the following mobile home parks in unincorporated San Mateo County:

- Bayshore Villa Manufactured Housing Community

- Belmont Trailer Park

- La Honda Trailer Park

- Pillar Ridge

- Redwood Trailer Village

- Sequoia Trailer Park

- Trailer Villa

What are the terms of the loan?

- The loan is a 30-year loan, though you may pay it off earlier.

- The interest rate is between 0.25 to 3.0 percent, depending on your income and your ability to afford the new home.

- The maximum loan amount is $100,000.

- No down payment is required.

- There is no maximum purchase price (loan based on income and affordability), however if the cost of the home and installation is more than $100,000, you will need to cover the difference.

If I qualify for the loan, what will be my monthly payment?

For a $100,000 loan, the payment can be as low as $288 monthly, or as high as $422 a month, depending on the interest rate.

When is the loan due?

Participants will pay monthly payments over 30 years, but the may become due and payable in full upon the following:

- Sale or transfer of the unit before the loan matures.

- Cash-out refinance – refinancing to convert the equity into cash.

- Default on loan terms, including renting/subletting the unit.

What kind of home am I allowed to purchase?

HEART will provide a list of preferred retailers/vendors. The type of home you can purchase must be either a HUD-certified manufactured home or a park model; the retailer/vendor will provide details on the type and available units. RVs or trailers cannot be purchased using this program. The retailer/ vendor will install the unit at the mobile home park. Please note that your ability to purchase may be limited by the size of the space you are renting.

What will the loan pay for?

The loan can be used for the demolition/removal of the old unit and the purchase, delivery, permits, and installation costs of the new mobile home. Licensing, registration, and related fees to be paid by the resident.

What is the process for purchasing a mobile home?

The process for purchasing a mobile home includes the following steps:

- Select a retailer/vendor from HEART’s list. Choosing a unit or vendor not on the list will require HEART’s approval.

- Provide a written agreement with the park owner authorizing the replacement/purchase of a new unit.

- Work with HEART to complete the closing process.

What documents are needed for the application?

You will need the following documents for your application:

- Proof of current residency in an eligible mobile home park

- Income verification (pay stubs, tax returns, bank statements, etc.).

- Written agreement with the park owner

Please note that HEART will also run a credit report

How long does the application process take?

The timeline may vary based on your specific situation and the completeness of your application. However, once all documents are submitted and verified, HEART aims to provide a Pre-Approval Letter within a few weeks.

What does it cost to apply?

There are no fees or additional costs associated with the MHLP Application.

What if I have bad credit or a lot of debt?

HEART will consider your circumstances and you may still qualify for a loan. Please contact us for more details.

HEART meets critical housing needs in San Mateo County by providing land acquisition, rehabilitation, and early funding to affordable housing projects for low-income residents.